Traders, this is Adam Harris, Ambassador to FXGlobe. Let’s prepare for a bustling week by recapping last week’s market movements.

Despite a few unexpected swells, we traversed a week brimming with potential and promise.

In the UK, we witnessed an uptick in the Claimant Count Change, an unanticipated turn signalling an increase in joblessness. This development reminded us that economies can be as unpredictable as the sea and reaffirmed our need to stay vigilant and agile.

Across the globe, the NZD’s Official Cash Rate maintained its course, while the USD found itself caught in a riptide as the CPI data surfaced lower than anticipated. The undercurrents of these shifts rippled through the markets, causing a marked decline in the USD.

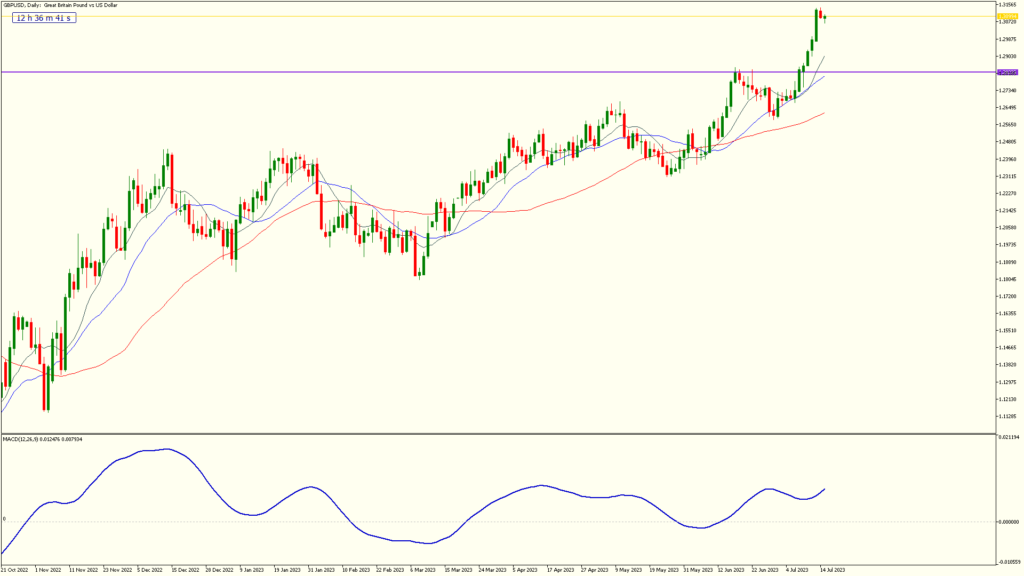

However, just like the ebb and flow of the ocean, these dips lead to rises elsewhere. The EUR and GBP rode the wave, shooting higher, invigorating Metals, Crude Oils, Cryptos, and Global Indices. Reflecting on the week, it’s clear that the markets weren’t just staying afloat – they were surfing the crest of a wave.

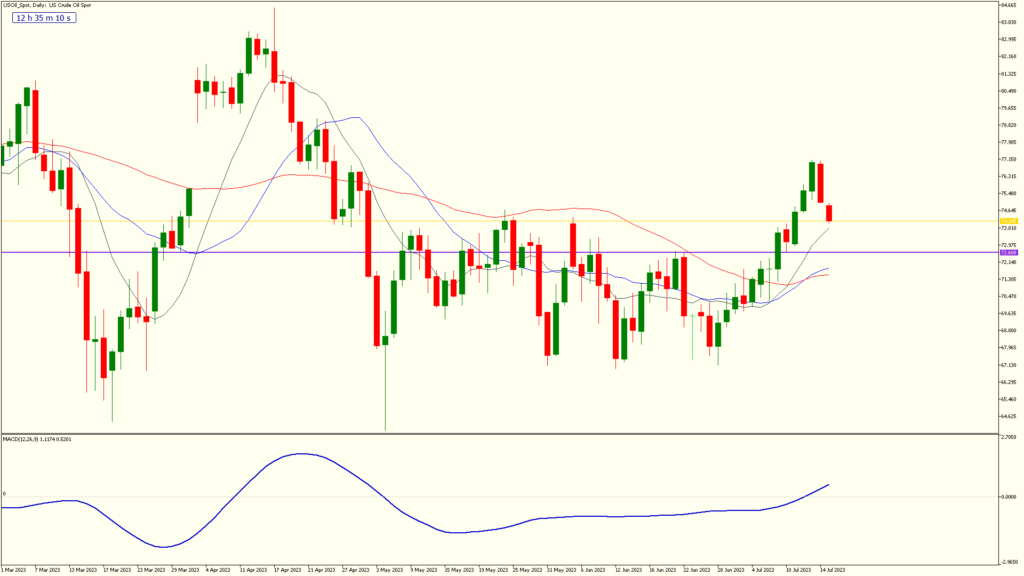

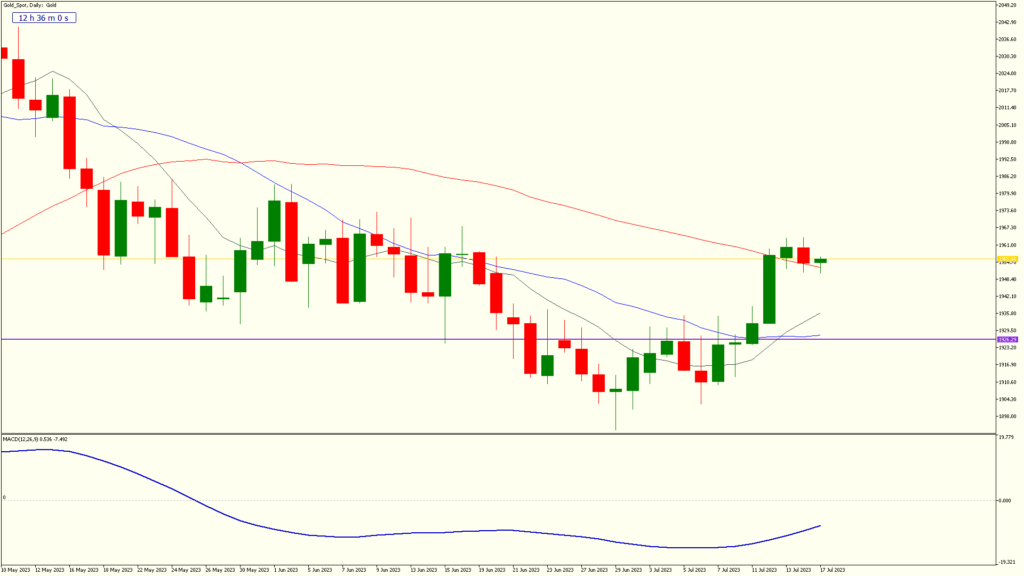

Let’s take a look at the charts to get some visuals of how the different asset classes climbed higher together:

The S&P500 Index

US Crude Oil Daily

Silver daily

Gold Daily

GBPUSD Daily

EURUSD Daily

Now, let’s set our compass for the coming week.

On Monday, keep your spyglass trained on the USD Empire State Manufacturing Index. Early weather signs suggest a potential drop. Tuesday’s horizon brings the AUD Monetary Policy Meeting Minutes and Canadian CPI data – valuable navigational aids for assessing the health of the US consumer sector.

By midweek, Wednesday asks us to keep an eye on the UK’s CPI data, our financial sextant guiding us through uncertain waters. Thursday presents us with Australian job data and concludes with the US Unemployment Claims.

From a technical standpoint, the week favours those who align with the current trends and brace for natural retracements. Being in tune with the markets’ rhythm can turn unpredictable swells into surmountable waves.

As your ambassador at FXGlobe, my aim is to help you sail smoothly through these financial seas. As we step into the new week, remember to keep calm, steady your compass, and carry on trading. Until next time, this is Adam for FXGlobe, charting the course for success.