Good morning, Traders!

After the previous weeks mixed volatility, and this weeks mostly CPI-oriented calendar news, traders should be prepared for potential surprises.

The existing trend across multiple asset classes is a weaker USD, but at the same time, day traders are anticipating a temporary retracement at some point.

For the most part, there should be many ‘with-trend opportunities, supporting the idea of many instruments heading higher.

Here are my market picks for today:

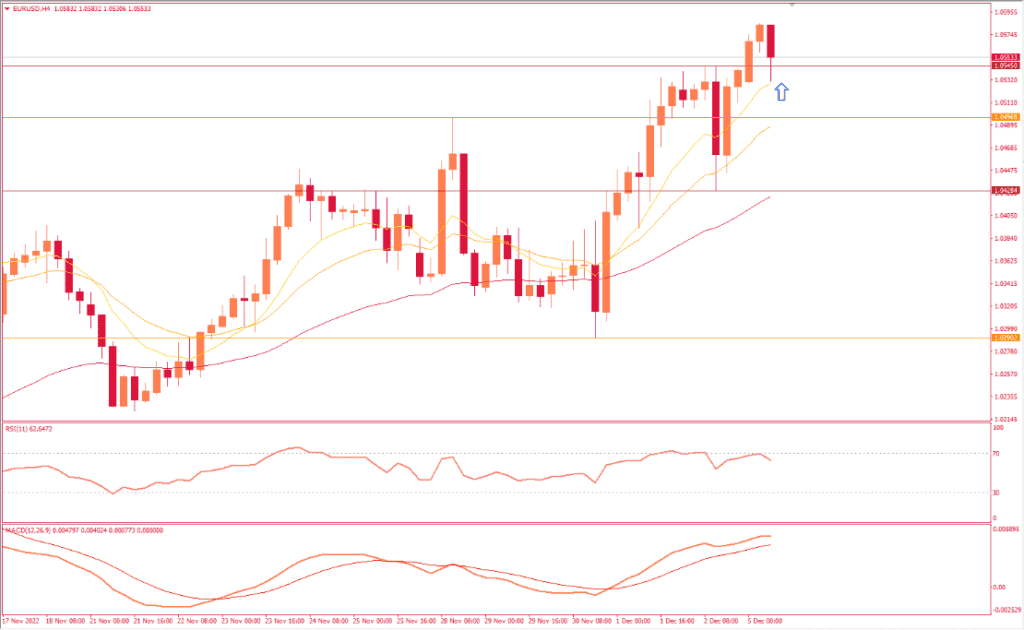

EURUSD, 4-hour, bullish retest

The 4hr EURUSD is currently retracing down and testing support of the old (prior/recent) highs.

I’m looking for the next candle, which will likely be after the U.S. session has started, to form as a bullish candle.

Should price action produce one or more bullish rejection candles displaying support at or around 1.0540 and above the line, there may be a bullish setup forming.

Usually this is confirmed when a bullish Momentum candle forms signalling a shift to the upside.

Traders that enter on the close of the bullish momentum candle, with their stop-loss below the lows of the candles usually target a 3:1 or key level above.

However, should price NOT encounter support when/if it retests the 1.0500-1.0550 area, then the bullish momentum may be fading, and the USD may be strengthening more than expected. Next up on my watchlist is

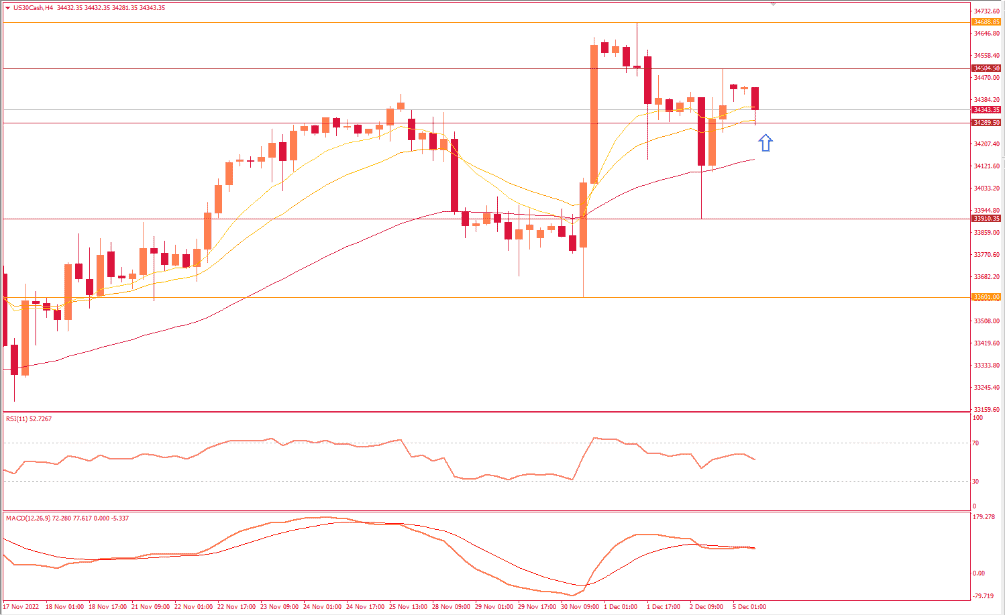

US30, 4-hour, Bullish.

The overall uptrend is healthy, and consistent. Price has recently pulled back into the 10/20 moving averages and I am waiting for it to produce a bullish momentum candle.

I’m now looking for a continuation of this bullish momentum to the upside.

Traders often enter on a break of the recent candles high (with 2-3 pips buffer), and a stop-loss below the most recent swing low, which in this case is below the most recent candle (again, with a 2-3 pip buffer).

Taking partial-profits at 1:1 is a great way to mitigate risk, as well as targeting a realistic price point, such as a major resistance level, or 1:3 risk-to-reward point.

Happy Trading!